By Brian McNally, PhD

Forming the bedrock of precision medicine is the use of in vitro companion diagnostic devices (CDx), with biomarker-specific assays leveraged to select therapeutics designed to ameliorate the repercussions associated with those biomarkers. The majority of the biomarkers targeted by CDx are made up of oncology-associated somatic DNA mutations or aberrant protein expression. These biomarkers are targeted by CDx to ensure that therapeutics matching specific molecular biomarkers are received by patients. For 13 years, the development of CDx was driven by diagnostic kit developers courting pharmaceutical companies, creating coveted exclusive test-drug pairings that would be blessed with a U.S. Food and Drug Administration (FDA) marketing authorization.

Rise of single site CDx testing

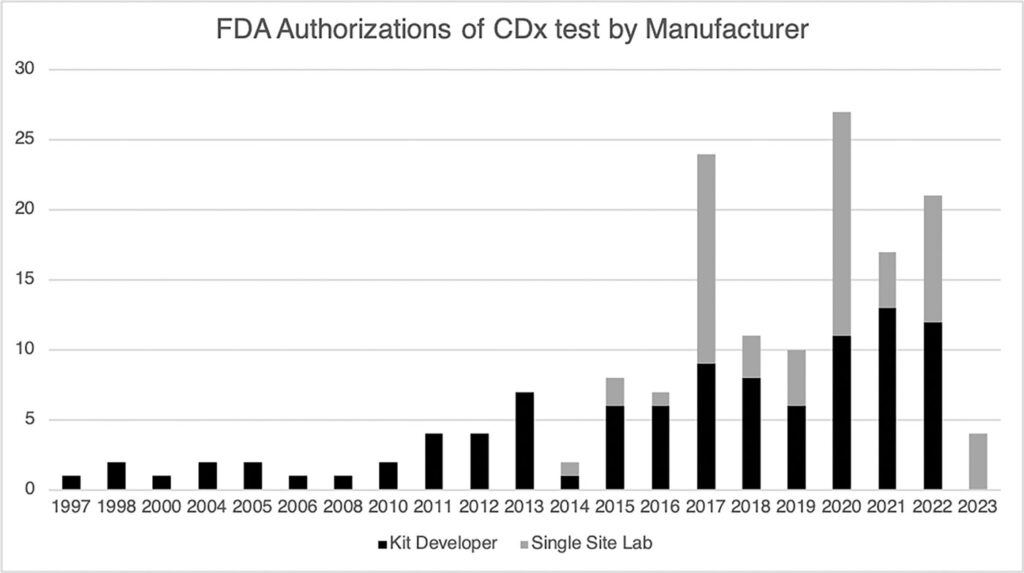

The technologies and reagents used in CDx kits have always been readily available, giving CLIA labs the means to develop laboratory-developed tests (LDTs) targeting the same biomarkers. LDT development of CDx assays provided the labs with an opportunity to improve performance, broaden sample compatibility, incorporate the tests into lab-specific automated workflows, and lower instrument and reagent costs. These development efforts raised commercial labs’ visibility, making them attractive suitors for pharmaceutical companies seeking a CDx partner. This opportunity was seized by single site labs, and they jumped into the CDx marketplace. Now, over the last three years, single site labs have outpaced diagnostic kit developers in new FDA clearances for CDx. However, two key considerations are missed by the FDA “scoreboard” because it only measures attempts by CDx providers (single site labs or kit developers) to have the test-drug marriage acknowledged by clinicians.

First, much larger panels of analyses can be tested using next-generation sequencing, creating opportunities to wed a single test to multiple pharmaceutical companies’ therapeutics. This increased biomarker testing capacity is reflected in tests such as FoundationOne CDx and Guardant360 CDx. The second consideration is CDx testing by labs using LDTs that have not sought or captured a pharma partner. Combined, these two drivers have reshaped the CDx marketplace and drive significant testing volume not only for patient care but also for clinical trials of future precision medicines. An example in the patient care setting is Intermountain, a hospital system, partnering with a commercial CLIA lab, Myriad Genetics, to broaden access to Intermountain’s tumor profiling test. On the clinical trial side, currently, no fewer than 20 interventional studies are leveraging single-site tests in their protocols.

Regulatory rhetoric

The promise of precision medicine is likely to be hindered by poor test performance. Last month, concern over poor or unreliable test performance was expressed by the FDA as it launched a final guidance document, “Oncology Drug Products Used with Certain In Vitro Diagnostic Tests: Pilot Program.” CDx LDTs that “may not provide accurate and reliable test results or perform as well as FDA authorized tests” were called out by the FDA. Even more dramatically, FDA Commissioner Robert Califf, MD, has been quoted as saying, “I hope that we come up with more capability of ensuring that the laboratory community is delivering more reliable tests.” This pilot program neatly fits into the larger narrative of the FDA, CMS, and the failed passing of the VALID act, specifically with the FDA proposing a program to target oversight of what are viewed as “high-risk” tests. Such finger-pointing drew the expected response from representatives of the lab community. As shared by American Clinical Laboratory Association President Susan Van Meter in Regulatory Focus on June 20, 2023, “At the same time, we are disappointed that FDA chose to disparage laboratory developed tests (LDTs) in its announcement of the program, rather than acknowledge and appreciate the critical and lifesaving role that LDTs play in our medical system.”

Over the coming year, CDx test data collected in clinical trials, provided by nine pilot program participants, will be leveraged by the FDA to generate minimum analytical performance characteristics. The synthesis of CDx test performance metrics (both analytical and clinical) within a regulatory body has been promoted within the European Union. Last year, a retrospective analysis of 167 medicines submitted between 2016 and 2020, provided by Marc Maliepaard and colleagues, highlighted a focus on clinical and analytical performance characteristics rather than CDx brand names. The authors argue that EMA is well educated on performance criteria for successful CDx and is a resource for both therapeutic and test developers via counseling notified bodies. The FDA plans to improve transparency by publishing minimum performance characteristics on a dedicated website, covering not only NGS but also PCR, Sanger sequencing, immunohistochemistry, and fluorescence in situ hybridization tests.

Future directions

The companion diagnostic market has been driven by technology and market demand, with reports of a 9% CAGR. These drivers have also reshaped not only how the biomarkers are tested but which organizations are developing CDx tests. Moving from kit developers creating exclusive relationships and marketing solutions to the lab market, the labs are engaging an almost equal share. In a somewhat ironic twist, Agilent, historically a kit developer, now offers a single-site CDx test. However, the constant over the past 25 years has been pharma companies having to marry at least one test for each of their therapeutics. The FDA, through comments made by Oncology chief Richard Pazdur, MD, indicates pharma in the U.S. should no longer be bound to static relationships in perpetuity. Moving forward, the publishing of a test performance floor is bound to bring new market entrants, reshape diagnostic strategies within pharma, and make oncologists the new matchmakers of CDx and therapeutics.

Brian McNally, PhD, specializes in life science tools/diagnostics strategy and marketing execution. Brian leverages his experience in growth strategy consulting, upstream and downstream marketing, and the lab bench to grow new and existing businesses. With successful instrument, reagent, software, and service product launches in oncology, infectious disease, immunology, and genetics, Brian enjoys driving synergistic approaches to portfolio management. This summer, you will find him outdoors, learning to cook pizza for his family and friends.