Obsidian Therapeutics this week closed an oversubscribed $160.5 million Series C financing to try and crack the immunotherapy for solid tumors problem. The financing was led by Wellington Management. Obsidian’s lead candidate, OBX-115, is a novel engineered tumor-derived autologous T cell immunotherapy (tumor-infiltrating lymphocyte [TIL] cell therapy) “armored with pharmacologically regulatable membrane-bound IL15 (mbIL15).”

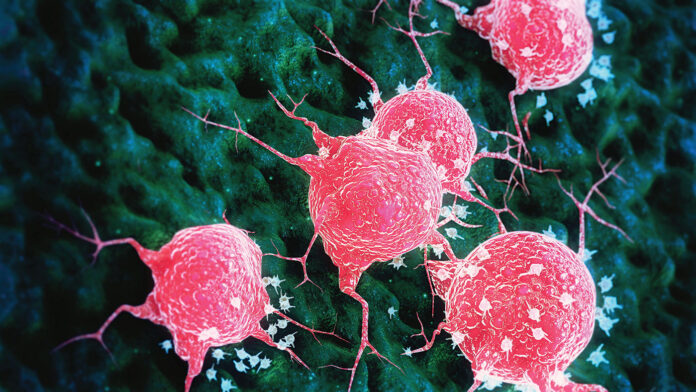

CAR T-cell therapy has been successful in treating blood cancers, but it hasn’t worked well for solid tumors, leading to many efforts to overcome this. Obsidian’s CytoTIL15 cells are manufactured from metastatic melanoma TIL donors by introducing mbIL15. Earlier studies showed that compared to unengineered TIL, generation of cytoTIL15 therapy from melanoma-derived TIL led to an overall 2.3-fold enrichment of reactive TIL.

The financing will advance OBX-115 in its ongoing trials for patients with melanoma and non-small cell lung cancer (NSCLC). The company is focused on enrolling patients and reaching key clinical and regulatory milestones, as well as manufacturing scale-up ahead of pivotal trial readiness.

Obsidian also announced the appointment of Ray Camahort, PhD, partner in the Venture Investments group at Novo Holdings U.S., to its board of directors.

“Obsidian’s engineered TIL cell therapy is highly differentiated and has the potential to bring transformational efficacy to patients with solid tumors,” said Camahort.

“Wellington is excited to be supporting Obsidian through its next phase of growth, as the Company continues demonstrating the potential of OBX-115 to address the unmet need of patients with immune checkpoint inhibitor-resistant advanced or metastatic melanoma. The Company has been generating momentum with its novel cytoDRiVE technology and advancing OBX-115 into late-stage clinical trials,” said Irina Margine, PhD, biotech sector lead at Wellington Management.

“The strong demand and support from this syndicate of premier investors is a testament to the promise of OBX-115 for patients with treatment-resistant advanced melanoma,” said Madan Jagasia, MD, CEO of Obsidian. “This financing provides funding through key clinical readouts in melanoma and is the catalyst to continue expanding OBX-115 into NSCLC, where there is significant potential and high unmet need.”

OBX-115 is aimed at patients with advanced or metastatic melanoma and other solid tumors by “leveraging the expected benefits of mbIL15 and Obsidian’s proprietary, differentiated manufacturing process to enhance persistence, antitumor activity, and clinical safety of TIL cell therapy.” OBX-115 is being tested in two ongoing and enrolling clinical trials in advanced or metastatic melanoma and NSCLC (NCT05470283 and NCT06060613).

Additional new investors participating in the financing include Foresite Capital, Janus Henderson Investors, Novo Holdings A/S, Paradigm BioCapital, RTW Investments, funds and accounts advised by T. Rowe Price Associates, Inc., and Woodline Partners LP. Existing investors Atlas Venture, Blue Owl Healthcare Opportunities, Bristol Myers Squibb, Deep Track Capital, Logos Capital, RA Capital Management, TCGX, Samsara BioCapital and Surveyor Capital (a Citadel company) also participated in the financing.

Obsidian’s proprietary cytoDRiVE technology is designed to “precisely regulate the timing and level of protein function by using FDA-approved small-molecule drugs.” The company is headquartered in Cambridge and has collaborations with Bristol Myers Squibb and Vertex Pharmaceuticals.