Bristol Myers Squibb is acquiring Orum Therapeutics’ ORM-6151 program for $100M upfront and total deal value of $180M. In a twist on antibody-drug conjugates (ADCs), Orum is pioneering Dual-Precision Targeted Protein Degradation (TPD²) and Targeted Protein Stabilization (TPS²). ORM-6151 is a first-in-class, anti-CD33 antibody-enabled GSPT1 degrader that has received the FDA’s clearance for Phase I for the treatment of patients with acute myeloid leukemia or high-risk myelodysplastic syndromes.

“We believe this agreement with Bristol Myers Squibb, a global leader in cancer with a strong legacy in protein degradation, validates Orum’s unique Dual-Precision Targeted Protein Degradation approach, which we pioneered to improve the therapeutic window and realize the full potential of targeted protein degraders through precision delivery to cancer cells via antibody-drug conjugates,” said Sung Joo Lee, PhD, CEO of Orum Therapeutics. “We are excited that Bristol Myers Squibb has acquired our ORM-6151 program with proprietary GSPT1 degraders, first-in-class targeted protein degraders with the potential to make an impact for patients with cancer.”

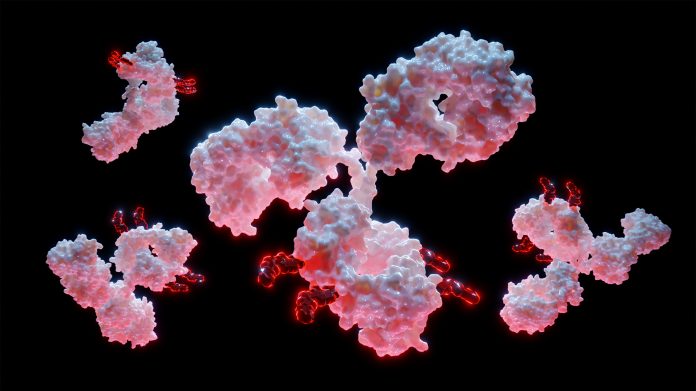

Orum’s GSPT1 platform uses the company’s Dual-Precision Targeted Protein Degradation (TPD) approach to build novel targeted protein degraders combined with the precise tumor cell delivery mechanisms of antibodies to generate tumor-selective TPDs for the treatment of cancer.

The company has developed new molecular glue degrader payloads to specifically degrade an intracellular target protein within cancer cells via the E3 ubiquitin ligase pathway. Conjugated to antibodies, the payloads are designed to be delivered specifically to cancer cells and degrade the intracellular target protein GSPT1 and cause tumor cell death.

ADCs have been a hot commodity this year, netting several deals worth potentially $1B or more.

In early April, BioNTech started its foray into ADCs through a deal with Duality Biologics worth up to $1.5B. Soon after, Bristol Myers Squibb signed a deal worth up to $1B for Tubulis to use the biotech’s “PS conjugation platform” to develop ADCs against solid tumors. In May, Eisai inked a clinical trial collaboration worth up to $2B with Bliss Biopharmaceutical. And in October, in a $4B upfront deal, Merck acquired three of Daiichi Sankyo’s ADC candidates.

Daiichi Sankyo is one of the leaders in the ADC field, which is estimated to be worth about $6B already. The breakout “HER2-low” drug Enhertu (from Daiichi and AstraZeneca) was approved for that subtype of breast cancer in August 2022. It is estimated to have raked in more than $1B that year.

But the biggest deal of all so far was Pfizer’s $43B acquisition of ADC specialist Seagen (formerly Seattle Genetics) in March. This deal doubled Pfizer’s early-stage oncology clinical pipeline. Four of the more than twelve FDA-approved and marketed ADCs have been developed using Seagen’s technology.

Orum’s GSPT1 platform uses the company’s TPD² approach to build novel targeted protein degraders combined with the precise tumor cell delivery mechanisms of antibodies to generate innovative, first-in-class, tumor-selective TPDs for the treatment of cancer. Orum has developed new molecular glue degrader payloads to specifically degrade an intracellular target protein within cancer cells via the E3 ubiquitin ligase pathway. Conjugated to antibodies, the payloads are designed to be delivered specifically to cancer cells and degrade the intracellular target protein GSPT1 and cause tumor cell death.